What Are the Taxes We Need to Charge for That Job?

Convoluted and overlapping tax jurisdictions, ever-changing remittance requirements, internal audits, and automation maintenance are just a few of the daunting tasks many concrete producers face today – The cost of getting this wrong is high. Misspent taxes, penalties, accounting adjustments, and bad publicity are just a few of the risks associated with inaccurate tax reporting.

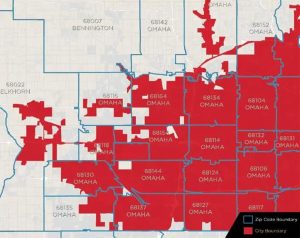

Overlaying ZIP Codes with municipal boundaries demonstrates that ZIP Code boundaries do not always conform to municipal boundaries. Image Credit: CoreLogic

|

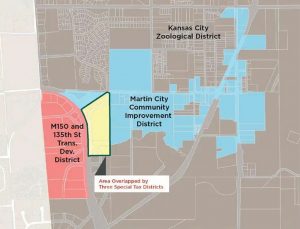

This CoreLogic® map identifies an area of Kansas City with three overlapping special tax districts (SpTDs). Image Credit: CoreLogic

|

To address these challenges, we have integrated CoreLogic’s Parcel-Level Tax Jurisdiction Data with our ConcreteGO Cloud dispatch. Upon entering the delivery address of an order, ConcreteGO will automatically match the address with the right tax jurisdiction and populate the tax code for the order.

The parcel-level geocoding ensures your full compliance with the tax laws and regulations. Aligning this number of customers’ delivery addresses with the correct tax jurisdictions could add hundreds of thousands of dollars to the bottom line when compared with using less accurate geocoding such as zip+4, which is still used by many commercial tax solution providers. Contact Us to learn more.

Click Here to learn more about why parcel-level geocoding is the more accurate approach that also brings more to your bottom line.